The Basics Of 1031 Exchanges

Having to pay taxes on real estate property can be overwhelming, to say the least. You pay for taxes on the purchase of the property itself, on any income earned, on capital gains, and depreciation recapture, not to mention all of the paperwork involved, changing lax laws, and the risk of filing incorrectly.

One option that long-term investors have if they want to avoid the hassle of filing taxes for various things related to their investment property is executing a 1031 exchange, also known as a Like-Kind Exchange. Simply put, this allows an investor to defer paying capital gains taxes when the proceeds from the sale of one property goes toward the purchase of another. However, there are several rules and stipulations that must be followed before a 1031 exchange can be approved. A real estate lawyer can go over the details of your situation to ensure that you qualify and that every detail is accurate.

THERE ARE FOUR TYPES OF REAL ESTATE EXCHANGES

- Simultaneous

- Delayed

- Reverse

- Construction or Improvement

Simultaneous

In this situation, the previous “relinquished” property is sold and a new “replacement” property is purchased on the same day. A simultaneous exchange does require that the closing occurs on the same day; any delay, even a short one, in the closing will result in a disqualification and the investor must pay full taxes. There are several ways the exchange can be completed:

- Swap: Two parties are involved in the exchange and the deeds of both properties are swapped.

- Three-Party: This exchange uses an “accommodating party” who facilitates the exchange.

- Intermediary: A simultaneous exchange done through an intermediary.

Delayed

The most common type of 1031 exchange is a delayed exchange, where a property is sold before another is purchased. The investor, known in these cases as the exchangor, must market the property, find a buyer, and execute a sale and purchase agreement. At that point, the delayed exchange can be initiated. When the property is sold, a third-party Exchange Intermediary will complete the sale and the profits will be held in a binding trust for up to 180 days. During this time period, the exchangor must find a property within 45 days and must purchase a like-kind property within 180 days.

Reverse

The opposite of a delayed exchange, a property is purchased through an exchange accommodation titleholder, and then the relinquished property is sold. This type of exchange is often more difficult as the process requires cash and it can be challenging finding a bank that will offer a reverse exchange loan. Just like a delayed exchange, the exchangor has 45 days to select a property that will be relinquished, then 135 days to complete the sale and purchase a replacement property. When these deadlines aren’t met, full taxes must be paid.

Construction or Improvement

In this case, profits from the sale on the relinquished property go toward improvements or construction on the replacement property. The replacement property is held by a qualified intermediary for the 180-day period. There are three requirements that the exchangor must meet to qualify for a construction exchange.

- The entirety of the profits from the sale of the relinquished property must be spent on improvements or as a down payment for the replacement property within 180 days.

- The replacement property must be chosen within 45 days.

- The replacement property must be appraised at equal or greater in value, and improvements must be completed before the property is deeded back from the qualified intermediary.

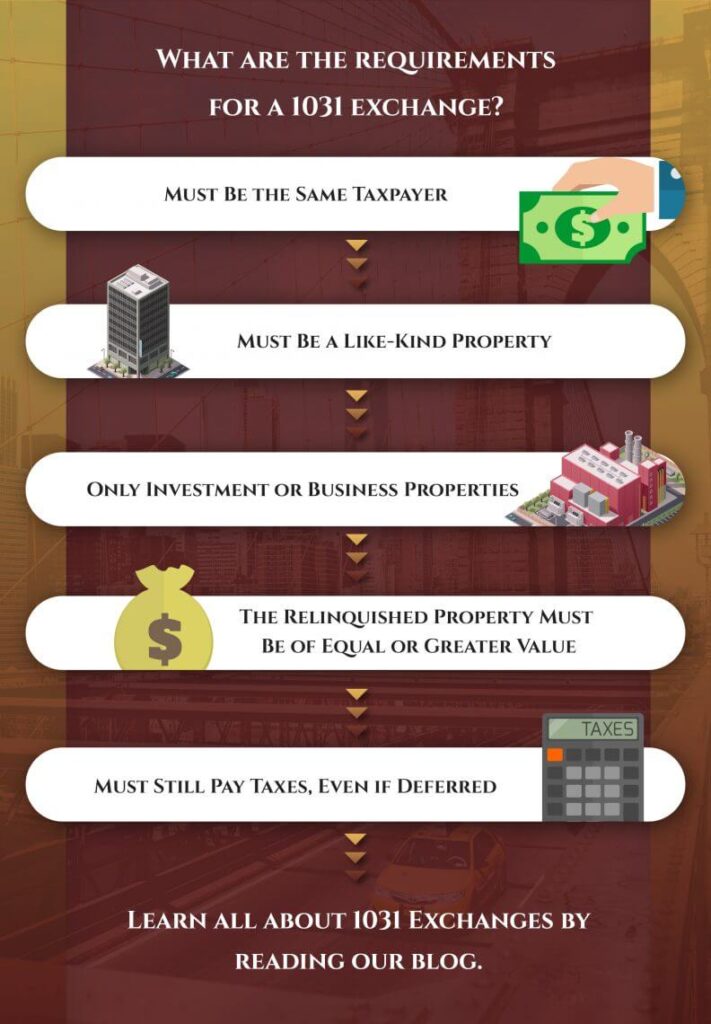

REQUIREMENTS FOR 1031 EXCHANGES

Must be the Same Taxpayer

The name of the taxpayer that appears on the title of the relinquished property must be the same name that appears on the tax return and title holder of the replacement property. An exception to this rule is in the case of a single member limited liability company or single member LLC (SMLLC). Rather than the individual selling the property, the LLC completes the sale and the single member is able to purchase the property in their name, rather than the LLC.

Must be a Like-Kind Property

The property being relinquished and the property being replaced must be “like-kind.” This means that the properties must be of the same nature, but they can, however, differ in quality or grade. For example, farming equipment cannot be exchanged for a commercial property because they are not of the same nature. In real estate transactions, nearly any type of property can be exchanged for another, with the exception of personal property. One exception to like-kind properties is that they both must be within the United States.

Only Investment or Business Properties

1031 exchanges are only permitted in cases where a commercial investment or business property is being sold and purchased. Exchanges are not permitted for personal property, including when the owner is moving from one state to another or is moving in with someone else and is selling their current home. If a single-family home is owned and operated as an investment property, it can be exchanged for another investment property, regardless of the location of either property (as long as both are within the U.S.).

Greater or Equal Value

The value of the relinquished property must be equal to or greater than the replacement property. When selling a commercial property for $700,000 with $300,000 in equity, the replacement property must be purchased at $700,000 or more, and have an equity of at least $300,000. An important consideration when pursuing a 1031 exchange is that you can sell one property and purchase multiple properties, as long as the values are equal. You can also sell multiple properties and purchase a single property, again, as long as the values are equal.

Tax-Deferred, Not Tax-Free

In any type of exchange, investors should remember that taxes are simply deferred. Taxes will still need to be paid on any profit earned when the property is sold in a non-1031 exchange sale. Any capital gain that was originally deferred, in addition to any additional gain since the purchase of the property is subject to tax.

As you can see, the 1031 exchange process can be beneficial for investors, but there are several complications that can occur as well as requirements that need to be met throughout the process. When deadlines aren’t met, when the property doesn’t meet certain criteria, or paperwork isn’t filed accurately, it could disqualify the exchange and investors will have to pay any necessary taxes related to the sale of the property.

Working with an experienced real estate lawyer who understands the details of the tax code will ensure that the process is completed correctly. The Law Office of Diron Rutty has been providing clients in the Bronx, the greater New York City area, and Poughkeepsie with real estate advice and guidance since 1995. Whatever your situation may be, our team of real estate attorneys can provide insight and guidance. Schedule a consultation with us today to get started.