Why You Need An Estate Plan

Estate planning is all about protecting your loved ones. While it may be more exciting to devote your time towards planning a vacation or even choosing what to eat for dinner over planning where your assets will go once you are gone, it is crucial for several reasons we will go over in today’s post.

Continue reading to learn about what an estate plan is and why having one is so important. If you have any questions or are ready to make your own, contact our professional estate lawyers at the Law Office of Diron Rutty in New York City today.

WHAT IS AN ESTATE PLAN?

While many people think that estate planning is only for the rich, it is actually something for everyone. Your estate consists of everything you own — including your home, car, any other real estate, checking and savings accounts, investments, insurance, personal possessions, furniture, and more. No matter how large or small, everyone has an estate. And this is where the key question comes into play — what will you do with your estate when you die?

When that happens, you will likely want to control how those things are given to those you care about. In order to make sure that your wishes are carried out, you need to provide instructions that state who you want to receive specific items of yours. And, of course, you want this to happen with the least amount paid in legal fees, taxes, and court costs. This is why it is absolutely necessary to do your estate planning with a reputable estate lawyer.

WHY YOU NEED AN ESTATE PLAN

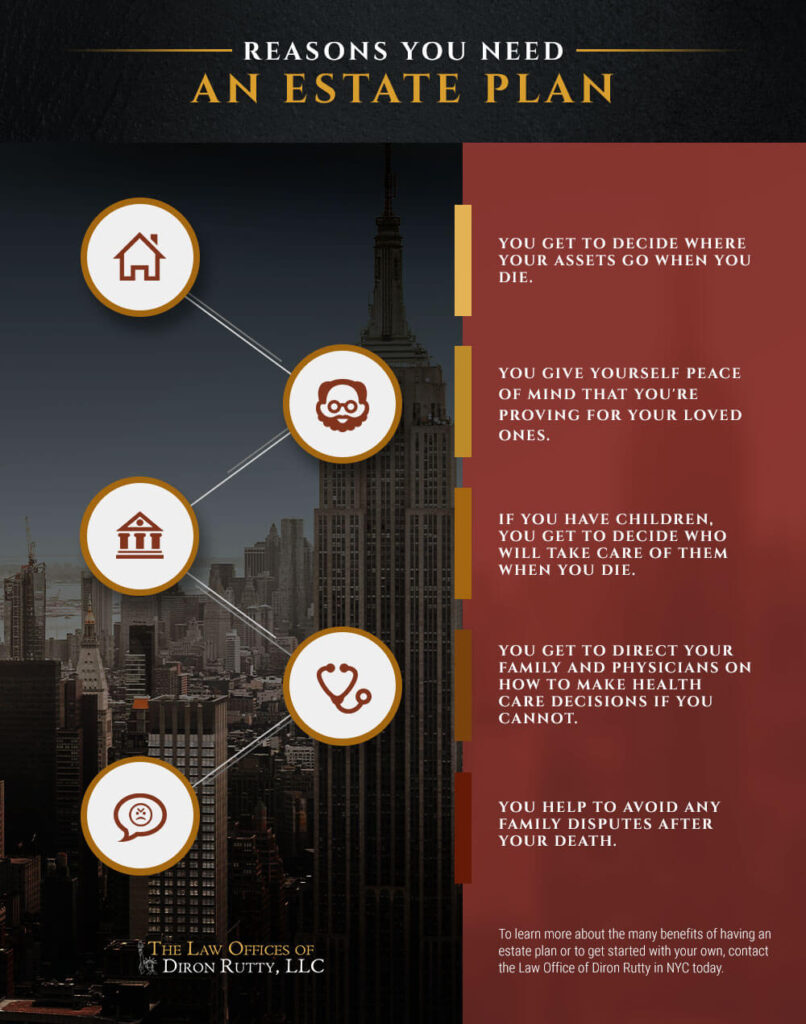

While there are many reasons why people decide to meet with an estate planning lawyer, here are five valuable reasons why it’s important to consider:

1. Prevent an Even More Difficult Time Once You Die

We see many clients who seek the advice of an estate planning lawyer after they experience a significant amount of time and money loss due to a loved one failing to make an estate plan for themselves. When you choose someone to be in charge if you ever become mentally incapacitated or die and decide who will get what, it will help to avoid unnecessary family arguments and potentially costly probate court proceedings.

2. Allows Your Loved Ones to Avoid Probate

When your loved ones are grieving your death, the last thing you want to put them through is a complicated legal and financial process. Probate is the legal process of administering a person’s estate after death which can be a lengthy and messy process if a clearly written will is not created. If you die without creating a will, the probate court will rely on your state’s intestate law in order to figure out how to distribute your estate.

3. Protects Your Beneficiaries

In general, there are two main reasons as to why people create an estate plan to protect their beneficiaries — to protect minor beneficiaries or to protect adult beneficiaries from bad decisions, creditor problems, outside influences, and divorcing spouses. You can help to prevent family strife by taking the time to designate a guardian and trustee for your minor beneficiaries, or if the beneficiary is already an adult that isn’t great at managing their money or has an overbearing spouse, you can create an estate plan that will protect them. At the Law Office of Diron Rutty, we can lay the groundwork for you to simplify the process and make it as streamlined as possible.

4. Reduces Estate Taxes

Another great motivator for many people to put together an estate plan is the fact that there is a significant loss of their estate to the payment of state and federal estate taxes or state inheritance taxes if there is not one in place. Even through the most basic of estate planning, married couples can reduce (or even eliminate altogether) estate taxes by setting up trusts as part of their wills.

5. Protect Your Assets

When you die, you want to make sure that your assets are protected. This is another big reason why so many people decide to meet with an estate planning lawyer. Starting with a sound financial plan and coupling that with a comprehensive estate plan will help to protect your assets for the benefit of both yourself during your lifetime as well as your beneficiaries after your death.

CREATE YOUR ESTATE PLAN TODAY WITH THE LAW OFFICE OF DIRON RUTTY

If you are ready to take the next step towards protecting your assets and your loved ones, reach out to our estate planning lawyers at the Law Office of Diron Rutty in New York City today. We have years of experience and extensive knowledge in the realm of estate planning and would be honored to set you up with a plan that will help you protect your future.